The current Elliot Wave structure of Bank of the Philippine Island (BPI) suggest that it ended Expanded Flat Corrective waves. Down from 7/19/2019 high (93.00) Wave 3, wave A ended at (88.00) and wave B ended at (95.00). Wave C ended at 86.25 or 123.6% Fibonacci Extension. Is this the start of the last impulsive wave 5? Wave 5 forecast target is at 103.00.

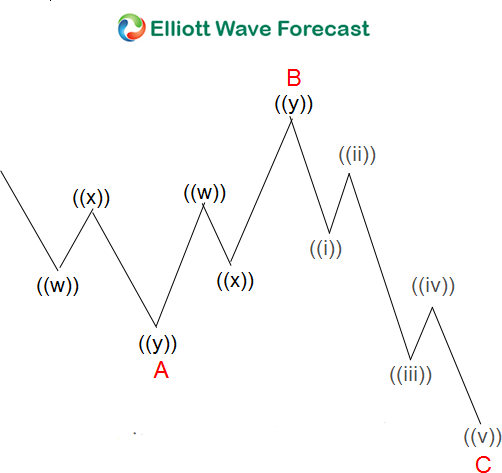

Expanded Flat is a 3 waves corrective pattern, and the inner subdivision is labeled as A, B, C with 3,3,5 structure. That means waves A and B are always corrective structures i.e. could be WXY, WXYXZ, Zigzag or any 3 waves corrective pattern. Wave C is either 5 waves impulse or ending diagonal pattern. In the graphic below, we can see what Expanded Flat structure looks like. Inner structure has ABC labeling, where wave B can complete below or above the starting point of wave A. Wave C should complete below the endpoint of wave A (usually at 1.236-1.618 Fibonacci extension A related to B).

No comments:

Post a Comment