The Elliott wave structure showed that the decline from $10, 955 to $9,755 was impulsive. It was labeled 1-2-3-4-5 and was followed by a W-X-Y Double Zigzag correction. Taken together, the impulse and the correction formed a complete 5-3 wave cycle pointing downwards.

A Technical Analysis of the Financial Market Using Fibonacci, Elliott Wave, Andrew's Pitchfork, Ichimoku, Moving Average and Different Chart Patterns

Pages

Friday, August 30, 2019

Tuesday, August 27, 2019

Philippine Stock Exchange Index (PSEi) ABC Zigzag Correction

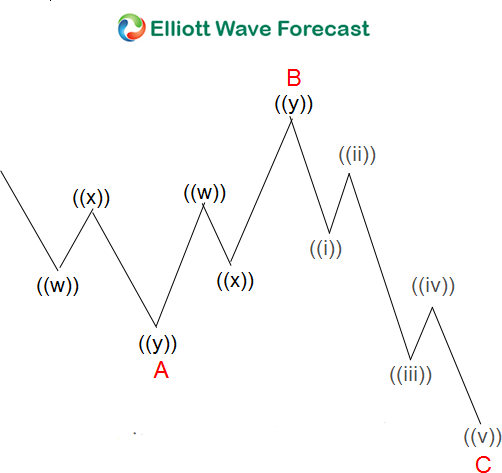

Philippine Stock Exchange Index (PSEi) may be making the last corrective WAVE (C) on a 5-3-5 or ZigZag Correction. Wave (B) just completed with Leading Diagonal at 8419.59. Wave (C) which is the last leg of ABC Zigzag correction is unfolded and it seems that the first impulsive Wave 1 has ended and currently making Wave 2. Wave 2 may go up to 8000 levels and after that, it will go down to complete Wave (C). Wave (C) is forecasted to end at 6271. The time period to complete Wave (C) maybe around 2nd Quarter of 2020.

The iShares MSCI Philippines ETF (EPHE) ABC Correction

The iShares MSCI Philippines ETF (EPHE) seeks to track the investment results of a broad-based index composed of Philippines equities.

EPHE maybe making the last corrective WAVE C on a 5-3-5 or ZigZag. Wave B just completed with Leading Diagonal at 37.15. Wave C which is the last leg of ABC correction is unfolded and it seems that the first impulsive Wave 1 has ended and currently making Wave 2. Wave 2 may go up to 35 levels and after that, it will go down to complete the impulsive wave of Wave C. Wave 5 of Wave C is forecasted to end at 27. The time period to complete Wave C maybe around December 2019.

Monday, August 26, 2019

Bank of the Philippine Island (BPI) in a Expanded Flat Correction

The current Elliot Wave structure of Bank of the Philippine Island (BPI) suggest that it ended Expanded Flat Corrective waves. Down from 7/19/2019 high (93.00) Wave 3, wave A ended at (88.00) and wave B ended at (95.00). Wave C ended at 86.25 or 123.6% Fibonacci Extension. Is this the start of the last impulsive wave 5? Wave 5 forecast target is at 103.00.

Expanded Flat is a 3 waves corrective pattern, and the inner subdivision is labeled as A, B, C with 3,3,5 structure. That means waves A and B are always corrective structures i.e. could be WXY, WXYXZ, Zigzag or any 3 waves corrective pattern. Wave C is either 5 waves impulse or ending diagonal pattern. In the graphic below, we can see what Expanded Flat structure looks like. Inner structure has ABC labeling, where wave B can complete below or above the starting point of wave A. Wave C should complete below the endpoint of wave A (usually at 1.236-1.618 Fibonacci extension A related to B).Sunday, August 25, 2019

Filinvest Land, Inc. (FLI) Complete ABC Correction

On July 16, 2019, the price of Filinvest Land, Inc. (FLI) drew a five-wave rally with an ending diagonal in the position of wave 5. Naturally, a three-wave decline followed. The retracement developed as a simple A-B-C zigzag and dragged the price down to almost exactly the 161.8% Fibonacci Extention.

Wednesday, August 21, 2019

Jollibee Foods Corporation (JFC) Completes Wave A of a ZIGZAG or 5:3:5 Correction

Jollibee Foods Corporation (JFC) is a Philippines-based a company engaged in the development, operation and franchising of quick-service

restaurants (QSR) under the trade name Jollibee. The Company has a number of

subsidiaries, which include FRESH N' FAMOUS FOODS, INC., which develops,

operates and franchises quick-service restaurants under the trade names Chow King

and Greenwich; RED RIBBON BAKESHOP, INC. (through RRB HOLDINGS, INC.), which

develops, operates and franchises restaurants under the Red Ribbon trade name;

MANG INASAL PHILS., INC., which develops, operates and franchises restaurants

under the Mang Inasal trade name, and PERF RESTAURANTS INC., which franchises

restaurants under the Burger King trademark in the Philippines. It also has

subsidiaries and affiliates, which develop and operate it's international

brands, Yonghe King, Hong Zhuang Yuan, San Pin Wang, brands under the

SuperFoods Group (including Highlands Coffee and Pho 24), Sma and Dunkin'

Donuts. Recently JFC acquired Coffee Bean & Tea Leaf (CBTL) for $350M.

JFC just completed Wave A at 217.20 and is about to make Wave B. This means it is about to make a 3-wave bounce (Wave B) and will most likely make a lower low in its Wave C. It is following a Zigzag structure which is 5:3:5. The chart below shows how a Zigzag

looks like in the Elliott Wave Theory.

The low at 217.20 on August 13, 2019, ended Wave A of the

Corrective ABC of Elliott Wave. JFC may go up and make Wave B. Wave B may rise

up to 50% Fibonacci Retracement of Wave A or 270 – 280. Base on Elliott Wave the

Fibonacci Ratio of Wave B in Relationship with Wave A is Wave B = 50%, 61.8%,

78.6%, 88.6%.This suggests a Range Trade for JFC with downward Bias.

After Wave B, the last corrective Wave C may be unfolded and forecasted between 200 to 160 levels. The Fibonacci Ratio rules and guidelines for WAVE C is Wave C = 61.8%, 100.0 or 123.6% of Wave A.

Just to put things in a better perspective, JFC completed a multi-year 5-wave structure known in Elliott Wave as impulse waves. It will take at least the same number of years at a minimum to complete its ABC corrective phase. The impulse wave started in the first quarter of 2017 and end in the first quarter of 2019. Then there’s a probability that the Corrective ABC will end on the last quarter of 2020. I hope that idea is clear enough for everyone to understand.

Subscribe to:

Comments (Atom)