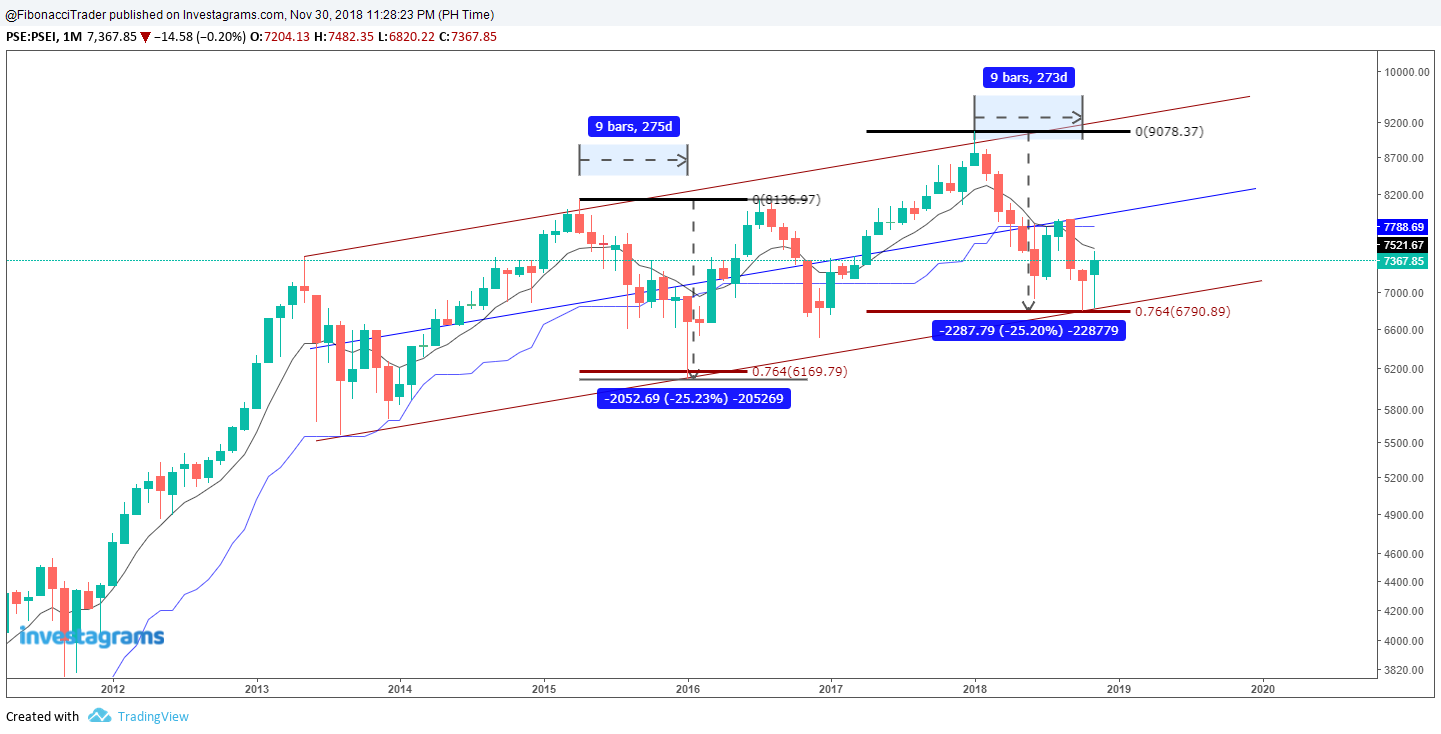

Below are the similaries of the Philippine Stock Exchange Index 2015 and 2018 Market Correction

1. The correction lasted for 9 months (275 days for 2015 and 273 days for 2018.

2. 2015 corrected by 25.23% while 2018 is 25.20% .

3. Both 2015 and 2018 retrace by 76.4 % Fibonacci Retracement Level.

A Technical Analysis of the Financial Market Using Fibonacci, Elliott Wave, Andrew's Pitchfork, Ichimoku, Moving Average and Different Chart Patterns

Pages

Friday, November 30, 2018

Sunday, November 25, 2018

Bitcoin / US Dollar (BTCUSD) Wave 4 is about to end

Looks like Bitcoin / US Dollar (BTCUSD) Wave 4 is nearing it's bottom. Support is seen at 3190.

RSI is also sitting at support. Bitcoin is seems to continue it's uptrend on the second quarter of 2019.

RSI is also sitting at support. Bitcoin is seems to continue it's uptrend on the second quarter of 2019.

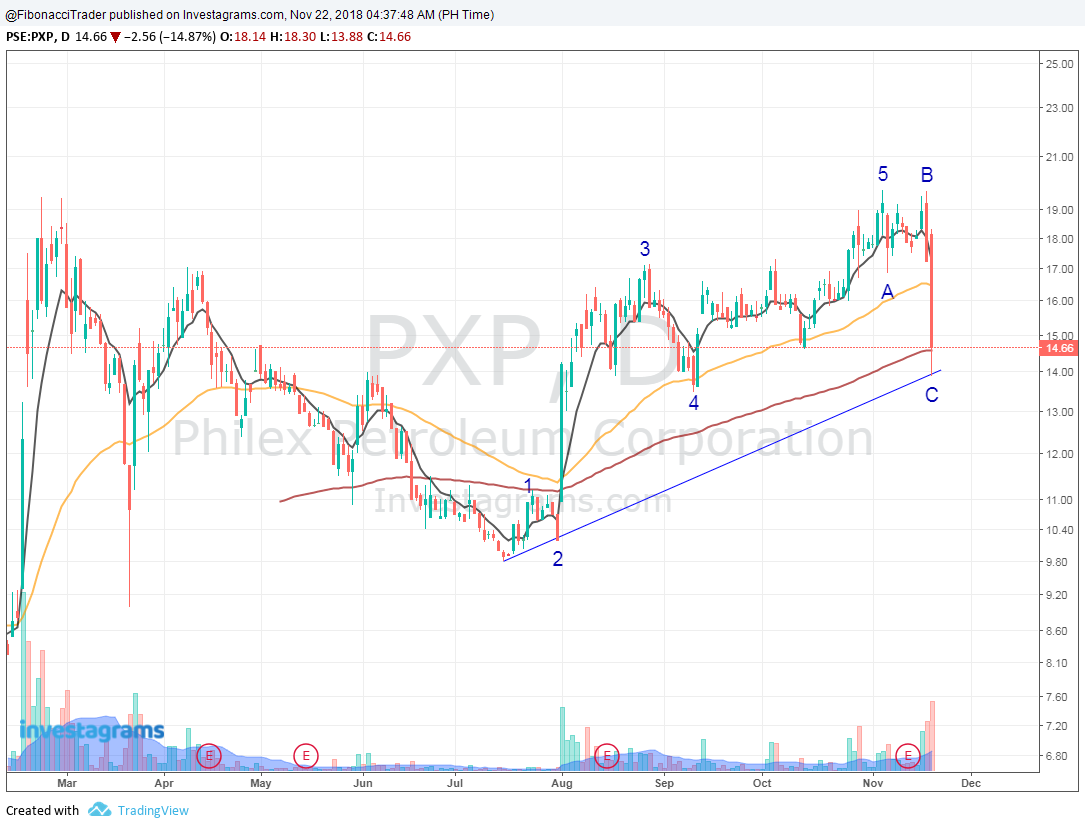

Thursday, November 22, 2018

Tuesday, November 20, 2018

Bitcoin / US Dollar (BTCUSD) Bullish Trend Line Broken

It's seems that Bitcoin / US Dollar (BTCUSD) breaks out downwards from the Bullish Trend Line.

Next support is seen at 4351.

Next support is seen at 4351.

Sunday, November 18, 2018

San Miguel Corporation (SMC) Grand Super Cycle Wave 5

It's seems the SMC is on it's way to Grand Super Cycle Wave 5 and currently making a expanding Diagonal Triangle.

Wednesday, November 14, 2018

Philippine Stock Exchange Index (PSEi) Wave 4 of Grand Super Cycle

>Philippine Stock Exchange Index (PSEi) is currently on wave 4 of Grand Super cycle.

>Wave 4 maybe between 7,168 and 4,076.

>Wave 5 of the Grand Super cycle is between 10,000 to 14,000.

>Wave 4 maybe between 7,168 and 4,076.

>Wave 5 of the Grand Super cycle is between 10,000 to 14,000.

Sunday, November 4, 2018

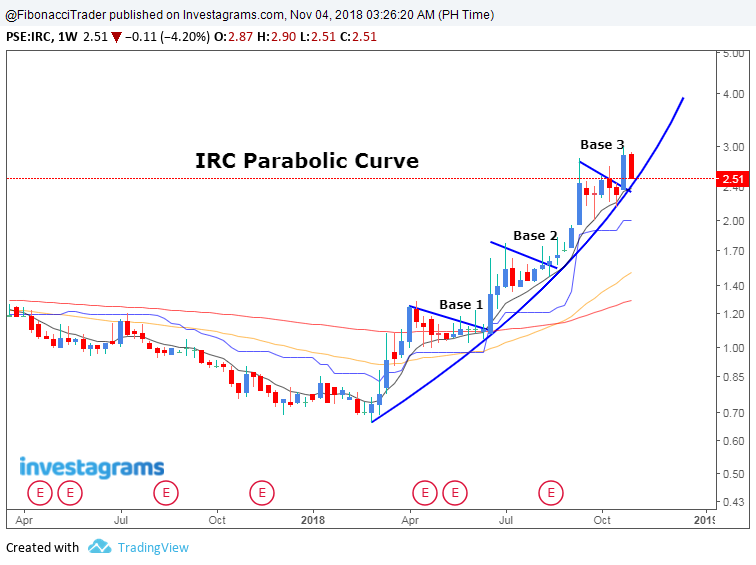

The Parabolic Curve Pattern IRC Properties, Inc.

Subscribe to:

Comments (Atom)