The Philippine Stock Exchange Index (PSEi) Monthly Chart closed with Bullish Hammer candle stick pattern.

A Technical Analysis of the Financial Market Using Fibonacci, Elliott Wave, Andrew's Pitchfork, Ichimoku, Moving Average and Different Chart Patterns

Pages

Wednesday, October 31, 2018

Vulcan Industrial and Mining Corporation - Voluntary Trading Suspension

Seating Above the 161.8% Golden Ratio

REQUEST FOR TRADING SUSPENSIONVulcan Industrial & Mining Corporation (Company) received certain communications after trading hours yesterday, for which the Board of Directors will hold a special meeting today, October 31, 2018, where proposals that may materially affect the future business direction of the Company are expected to be taken up.

Stock Symbol(s) of Affected Securities

VUL

Trading Suspension Details Execution Date Oct 31, 2018

Execution Time 9:00 AM

Lifting Date Nov 5, 2018

Lifting Time 9:00 AM

Reason(s) for the request

The proposals that are expected to be taken up during the Board meeting may affect market activity with respect to listed VUL securities and lead to speculation prior to board action on the proposals. The trading suspension will enable the Company to provide its shareholders and the investing public with equal opportunity to (a) examine the details of the results of the Board meeting, and (b) fully appraise their investment position in VUL shares in light of such results.

http://edge.pse.com.ph/openDiscViewer.d ... A3Ksw.dpbs

Tuesday, October 30, 2018

USD/PHP Philippine Peso Forecast : 52

The chart is telling us that we will have a stronger peso this coming days and it is foretasted to go down to 52 level to complete the Potential Bullish Cypher Harmonic Pattern.

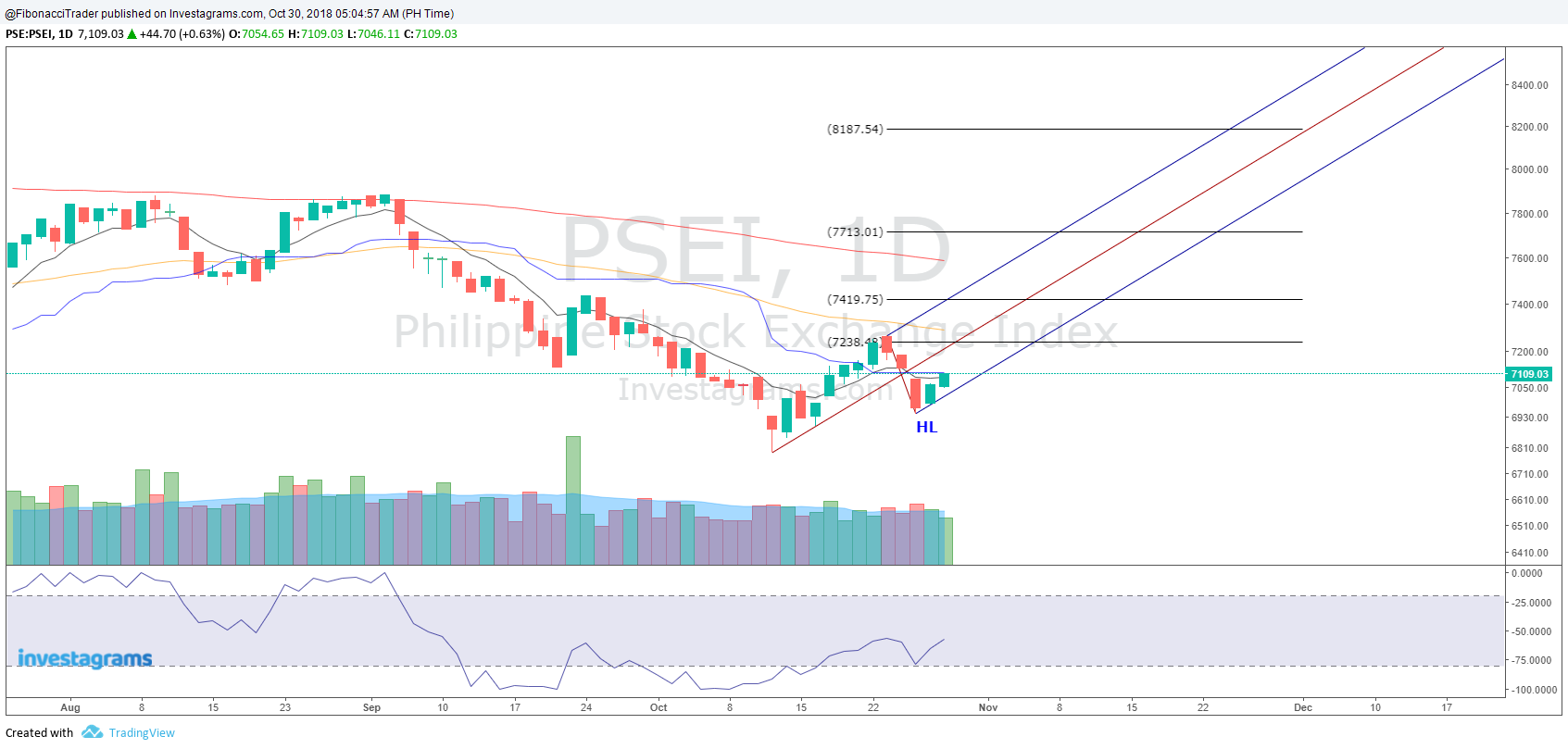

Philippine Stock Exchange Index (PSEi) Makes Higher Low

Looks like Philippine Stock Exchange Index (PSEi) made Higher Low which is positive. If it breaks 7238 then the next resistance is at 7419. Support is seen at 6941.

Sunday, October 28, 2018

Tuesday, October 23, 2018

All Shares Index ABC Correction Finish

It seems that the All Shares Index completed the ABC correction of Elliot Wave in confluence with the completion of a Bullish Alt Shark Harmonic Pattern. All Shares Index needs to break 4495 to negate the downtrend.

Refer to my previous analysis : http://www.fibonaccitrader618.com/2018/10/all-shares-index-potential-bullish-shark.html

Refer to my previous analysis : http://www.fibonaccitrader618.com/2018/10/all-shares-index-potential-bullish-shark.html

Sunday, October 21, 2018

Gold Breaks From Down Trend Line

Looks like gold found major it's support at 1160 and broke from the downtrend line after 2 months of consolidation. It might retest first the 1200 area before it will go higher. Resistance is seen at 1238 and 1262 while support at 1200.

Wednesday, October 17, 2018

iShares MSCI Philippines (EPHE) Bullish Alt Shark

iShares MSCI Philippines (EPHE) retested the Potential Reversal Zone (PRZ) of A Bullish Alt Shark Pattern. There is also a Bullish Divergence between the price and indicator.

Thursday, October 11, 2018

Dow Jones Industrial Average (DJI) - Double Top

Dow Jones Industrial Average (DJI) completed a Double Top pattern. Support is seen at 25573 then at 25148.

Wednesday, October 10, 2018

All Shares Index Potential Bullish Shark

It seems that All Shares Index is currently making a Potential Bullish Shark that aims to be completed between 4215 to 4330 level. This is also in confluence with the final wave C of the Corrective ABC of Elliot wave.

Saturday, October 6, 2018

Inflation zoom to new 9-year high of 6.7% in September

The Philippines' annual inflation rate rose to 6.7 percent in September of 2018 from 6.4 percent in the previous month, and compared to market expectations of 6.8 percent. It is the highest reading since February 2009. due to a surge in prices of food and a faster rise cost of transport. On a monthly basis, consumer prices went up 0.8 percent, after a 0.9 percent rise in August. Inflation Rate in Philippines averaged 8.40 percent from 1958 until 2018, reaching an all time high of 62.80 percent in September of 1984 and a record low of -2.10 percent in January of 1959. (source: https://tradingeconomics.com)

Subscribe to:

Comments (Atom)